is inheritance taxable in utah

Minnesotas estate tax exemption is 3 million but the state looks back to include any taxable gifts made. A The taxable value of the family home subject to adjustment as authorized by subdivision b of Section 2 determined as of the date immediately prior to the date of the purchase by or transfer to the transferee.

Historical Utah Tax Policy Information Ballotpedia

Salt Lake City Utah 84106 801 467-4450.

. Impose estate taxes and six impose inheritance taxes. The Kindest States for Lottery Taxes Your best bet for avoiding lottery taxes is to live in a state that doesnt have an income tax at all as of 2022. The COVID-19 pandemic has had a significant impact on local Social Security offices in Utah.

The site is secure. The amount of the tax is in proportion to the amount subject to taxation. If the employee earns more than the taxable wage base then the amount over the taxable wage base is not taxable.

Obtain the Trust Documents. Florida South Dakota Texas Washington Tennessee and Wyoming. Read the trust documents to understand the trust terms and find the names.

Processed items - Such as products that were processed by third parties and have more value than their original precious metals content eg. Other items taxable under Indiana state law include. Utah does not exempt Social Security retirement benefits from taxation so expect to pay state taxes on any Social Security income thats included in your adjusted gross income AGI.

Inheritance and Estate Taxes. Are other forms of retirement income. Does Utah Have an Inheritance Tax or an Estate Tax.

Business and farm income. Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico North Dakota Rhode Island Utah and Vermont tax Social Security income. Of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than.

Twelve states and Washington DC. Colorized coins black rutheniumgold plated coins etc Iowa State Information. Utah has a flat tax.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The new taxable value of the family home of the transferee shall be the sum of both of the following. Obtain the original revocable trust documents along with any amendments or trust restatements.

Utah does not collect an estate tax or an inheritance tax. West Virginia taxes Social Security to some extent but is phasing that tax out entirely by 2022. Of course municipal bonds usually earn less income than other taxable bonds but they can still be a worthwhile strategy for reducing your tax burden.

Accessories - Such as holders tubes coin flips and similar apparel. Wages for each employee are subject to contributions up to the taxable wage base for the year. What Are Allowable Deductions.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Additionally Utah has no estate or inheritance tax. The https ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

These offices have been closed to the public for walk-ins for nearly two years but the Social Security Administration recently announced the reopening of local field offices. Other states that dont participate in Powerball are Alabama Alaska Idaho Nevada and Utah. The taxable wage base changes every year.

Thus saving money on property taxes and maximizing your inheritance. Is Social Security taxable in Utah. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

As long as you are the grantor of your revocable trust you can sell property held in trust the same way you would sell any property titled in. Taxable 175 state tax plus mandatory 125 in local and county taxes Clothing. Taxable unearned income may include.

A proportional tax is a tax imposed so that the tax rate is fixed with no change as the taxable base amount increases or decreases. It is possible to reduce taxable income by contributing to a retirement account like a 401k or an IRA. Profit from the sale of assets.

632 North Main Street Logan Utah 84321 435 750-5566. However state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million in 2022 2412 million for couples. Wages in excess of the taxable wage base are not subject to contributions.

Only 13 states impose a tax on Social Security income. Maryland is the only state to impose both. The local offices in Utah are expected to reopen to the public in March 2022.

Proportional describes a distribution effect on income or expenditure referring to the way the rate remains consistent does not progress from low to high or high. The Utah income tax rate is 495.

Utah State Income Tax Calculator Community Tax

State Estate Tax In Utah Shand Elder Law

Utah State 2022 Taxes Forbes Advisor

Capital Gain Tax In The State Of Utah What You Need To Know Capital Gains Tax Capital Gain Education Savings Account

Why You Need A Will Probate Divorce Lawyers Attorneys

Is My Student Loan Debt Dischargeable In Bankruptcy Divorce Lawyers Family Law Attorney Divorce Attorney

Utah State 2022 Taxes Forbes Advisor

Utah Estate Inheritance Tax How To Legally Avoid

Estates And Trust Services 801 676 5506 Free Consultation Tax Lawyer Inheritance Tax Family Law Attorney

Utah Probate Filing Fees Probate Family Law Attorney Divorce Lawyers

Utah State 2022 Taxes Forbes Advisor

The Ultimate Guide To Real Estate Accounting And Taxes In Utah

A Guide To Inheritance Tax In Utah

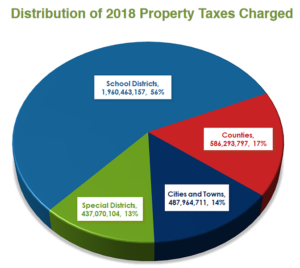

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers